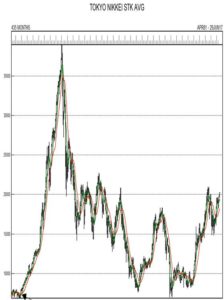

Note: There will be a special section coming soon, Nikkei with Rules, in the Rules Based Investing section of the TWP website.

If you had bought at the Nikkei Peak in 1989, you would have had a -2.43% annual Rate of Return (28 years later).

Japanese asset price bubble

Link: Japanese asset price bubble

Extract: The Japanese asset price bubble was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble collapsed. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion. More specifically, over-confidence and speculation regarding asset and stock prices had been closely associated with excessive monetary easing policy at the time.

By August 1990, the Nikkei stock index had plummeted to half its peak by the time of the fifth monetary tightening by the Bank of Japan (BOJ).[2] By late 1991, asset prices began to fall. Even though asset prices had visibly collapsed by early 1992, the economy’s decline continued for more than a decade. This decline resulted in a huge accumulation of non-performing assets loans (NPL), causing difficulties for many financial institutions. The bursting of the Japanese asset price bubble contributed to what many call the Lost Decade.